New research reveals spike in consumers and businesses cancelling insurance cover.

Rising premiums and a fall in income are seen as the main reasons for insurance becoming too expensive and having to be cancelled.

New research reveals that in the past 12 months, there has been a spike in consumers and businesses cancelling insurance because they can no longer afford it, resulting in greater numbers of underinsured and a sharp rise in insurance 'blackspots'.

Over the next 12 months, the findings reveal millions more are considering cancelling insurance because of cost and the two main reasons for this are rising premiums and a fall in income.

The research(1) commissioned by Premium Credit, the UK's leading premium finance company, reveals 38% of people have cancelled one or more insurance policies over the past three years because they can no longer afford them, and in 56% of these cases, cancellations occurred in the past 12 months. For SMEs, the corresponding figures are 33% and 50% respectively. The findings are being released today at the British Insurance Brokers' Association (BIBA) conference in Manchester.

However, around a quarter (28%) of people who have cut back on car insurance cover admit to still having a car, while 51% who have a mortgage don't have home insurance, which most lenders require them to have.

Similarly, it is compulsory for businesses to have employers' liability cover for example, but 16% of employees think the organisations they work for have cancelled this in the past three years.

Premium Credit's research reveals that over the next 12 months, some 12 million people are considering cancelling insurance policies.

Adam Morghem, Strategy and Marketing Director at Premium Credit said: "It is shocking to see so many people and UK businesses missing out on vital, sometimes legally necessary cover due to cost or concerns over payments. This is leaving millions exposed to unnecessary risks and potentially even greater costs further down the line.

"There are ways to avoid these so-called insurance blackspots. Premium finance enables people to spread the cost of cover instead of paying for it all in one go and was specifically developed to help businesses and consumers pay for insurance more efficiently and effectively - particularly the necessary, often vital protection they need every day."

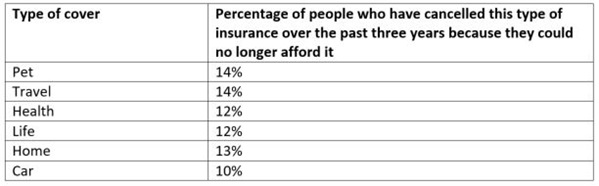

Consumers cancelling insurance

In terms of the insurance policies people have cancelled over the past three years, Premium Credit's insurance reveals 14% claim to have terminated pet cover, and the same percentage have stopped their travel insurance. This is followed by 12% who claim to have done the same with health insurance, and also life cover.

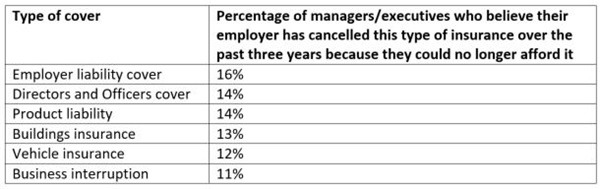

Businesses cancelling insurance

Premium Credit's survey with managers/executives at businesses reveals 16% believe their employers have cancelled Director and Officers cover, and the same have done the same with their product liability insurance.

Rising premiums and a fall in income makes insurance too expensive

In terms of why people have stopped paying for insurance because they could no longer afford it, 40% said it was because premiums have become too expensive, while 21% said they cut back because they suffered a significant drop in income. For SMEs who have cut back on insurance because they can no longer afford it, 42% said it was because they saw a drop in their income, and 38% said it was because of increases in premiums.

Premium Credit is the market leader in the UK and Ireland and the only premium finance provider accredited by BIBA.

1 Consumer Intelligence conducted research with 1,198 adults aged 18-plus and 499 SME owners and managers between 9th to 10th April 2019.

There are ways to avoid these so-called insurance blackspots. Premium finance enables people to spread the cost of cover instead of paying for it all in one go.